Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then

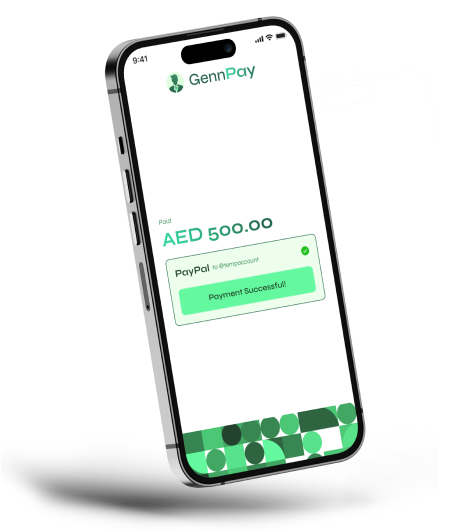

Streamline your financial operations with our advanced payment gateway solutions. Whether you’re a startup or an enterprise, we offer secure and efficient services to manage all your transactions effortlessly.

Seamlessly handle international transactions with our multi-currency support.

Automate your revenue processes for increased efficiency and accuracy.

Lower expenses, increase earnings, and streamline operations using a unified platform for your business.

Process transactions online, in person, or through your platform.

Accelerate your business with automated revenue and financial systems.

Integrate financial services into your platform or product.

Make payouts and handling transactions effortless as your business progresses through different growth phases.

Explore our comprehensive digital banking solutions designed to streamline your financial activities and enhance your banking experience.

For startups and growing companies

For mid-sized companies looking to scale

For global enterprises with custom needs

Experience transformative digital banking journeys with GennPay, revolutionizing financial experiences using advanced technology.

Entrepreneur

"As an entrepreneur, the tools offered by Gennpay's platform have revolutionized my operations, simplifying transactions and facilitating data-driven growth."

Tech-savvy User

"This Gennpay's Dashboard is user-friendly and intuitive, providing easy access to financial data for effortless payouts and invoicing."

Discover how modern technologies are changing finance, offering effective, secure solutions for everyone.

A payment gateway is a technology that enables merchants to accept payments from customers via various methods, such as credit cards, debit cards, and online banking. It securely captures and transfers payment information from the customer to the merchant’s acquiring bank, facilitating the transaction process.

A payment gateway works by capturing payment details from the customer and securely transmitting them to the acquiring bank. Here’s a simplified process:

Benefits of using a payment gateway include:

Payouts in a payment gateway system refer to the process of transferring funds from the merchant’s account to their bank account. This involves:

Common fees associated with payment gateways include:

When choosing a payment gateway, consider the following factors:

Payment gateways offer several security measures to protect transactions, including:

Where we navigate the evolving landscape of financial technology, digital banking solutions, and innovative payment systems.

Welcome to WordPress. This is your first post. Edit or delete it, then